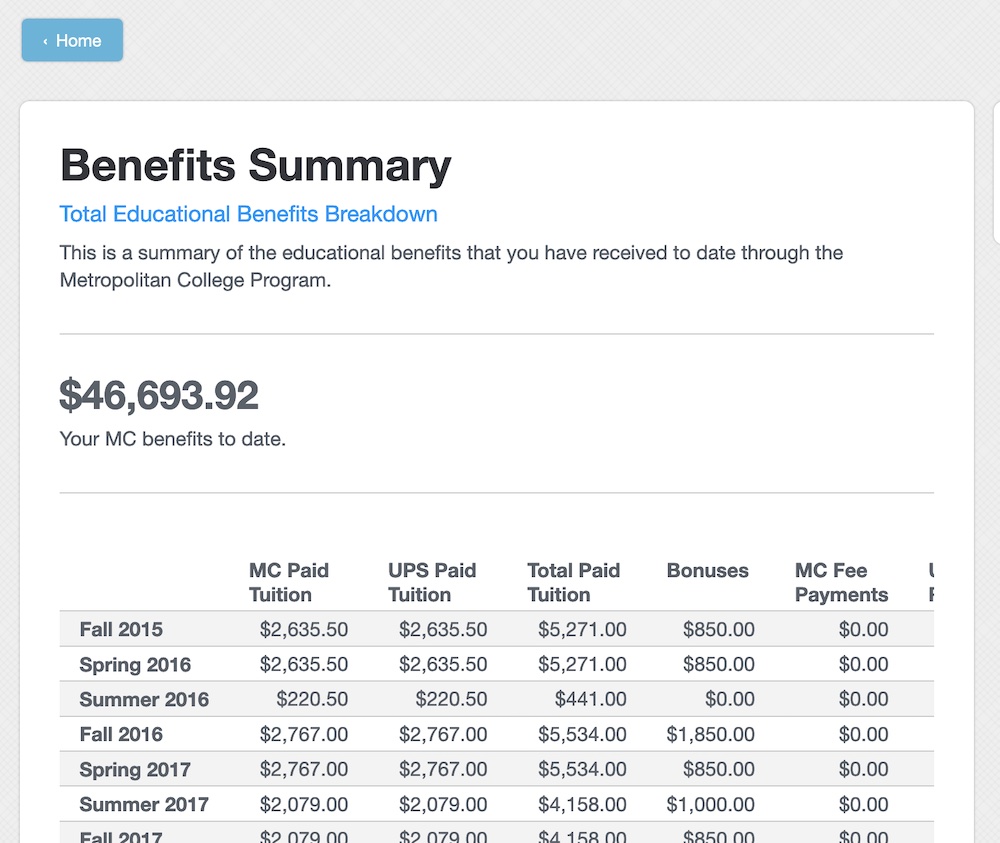

Benefits Summary Details

The total benefits can be viewed by semester. This section also includes an overview of the $5250 guideline.

Per IRS guidelines, an employer can pay up to $5,250 a year in tax-free education benefits. This total is calculated by adding 50% of tuition paid by UPS and any other taxable benefits (Ex: fee payment assistance) for an academic year (fall, spring and summer). Any amount paid by UPS over $5,250 will be taxed like your wages.

If you exceed the limit, UPS will notify you when the taxes will be deducted from your UPS paycheck. Due to higher tuition rates, UofL students will reach this limit sooner than JCTC students.